The cladding on Grenfell Tower caused the fire to spread so quickly

On 14 June 2017, a fire broke out at Grenfell Tower. It burned for 60 hours and 72 people died.

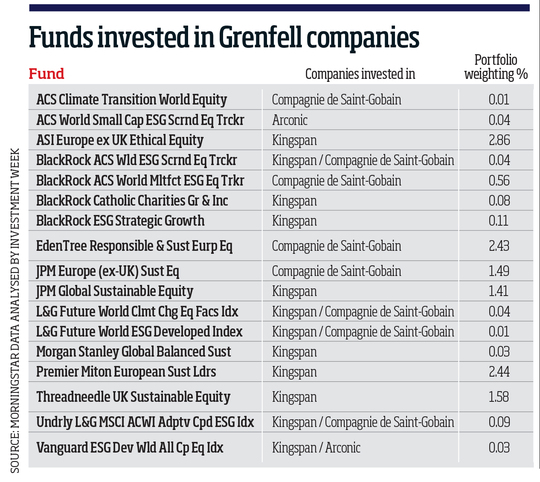

Almost five years on, 17 UK-domiciled funds with an explicit mandate for promoting good ethical, social and governance practices remain invested in companies whose employees have admitted wrongdoing.

Using Morningstar data, Investment Week has found that each of these funds have an allocation to one or more of three companies, each of which engaged in malpractice related to the cladding and insulation used on Grenfell Tower, which has been cited as dangerous and caused the fire to spread so quickly.

interactive investor urges FCA to clarify ESG terminology

Arconic is an industrial company whose employees have admitted to selling cladding they knew was flammable without informing customers of this.

Kingspan is an insulation firm whose employees have admitted to keeping historical fire test reports secret and misrepresenting its products.

Compagnie de Saint-Gobain is a multinational manufacturing conglomerate that owns Celotex, whose employees admitted to being dishonest in order to sell its products, which contributed to the fire at Grenfell Tower.

The ESG-explicit funds that hold at least one of these three companies are managed by nine asset managers: abrdn, BlackRock, EdenTree Investment Management, JP Morgan, Legal & General, Morgan Stanley, Premier Portfolio Managers, Threadneedle Investment Services and Vanguard Investments UK.

While many more explicitly ethical funds around the world hold the firms, Investment Week has made the decision to focus on those domiciled in the UK for now.

Investment Week received data from Morningstar on all funds that held the firm on 31 December 2021, which was then analysed for key words relating to ESG.

Only two fund houses, EdenTree and abrdn, responded to a request for comment, with all others either failing to reply or declining to comment.

EdenTree Responsible and Sustainable European Equity fund aims to invest in companies that "make a positive contribution to society and the environment through sustainable and socially responsible practices".

A spokesperson for the firm explained it had placed "an immediate investment stop on St Gobain in November 2020 so that fund managers could not add to their holdings", adding they had regularly engaged with the firm, with the most recent conversation on 4 March 2022.

They added: "The company maintains that the cladding products they sell (and sold) are safe if installed according to the design requirements. It is cooperating fully with the government on this investigation to ensure their products are not used in this way again."

Manager of the Quilter Cheviot Climate Assets fund Claudia Quiroz, which was at one point invested in Kingspan, revealed she sold the company as a direct result of its involvement in the Grenfell Tower fire.

"While Kingspan does provide solutions around energy efficiency in construction and had been a long-standing core holding, we felt divestment was in line with the spirit of the fund and the wider sustainable strategy," she said.

"Our philosophy is identifying companies that are providing solutions to the economic and environmental impacts of climate change, but we place equal emphasis on identifying those who work towards greater social and community impact, underpinned by a strong company culture that strive to do the right thing."

MainStreet report reveals 70% of funds not sustainable

A portfolio manager at King & Shaxson Harry Thompson described the process it had taken upon hearing the allegations.

"We engaged with all fund houses, as we do with any controversy," he said. "Of the names mentioned, Kingspan was held in a few collectives within our model portfolios (we know this from the ongoing underlying screening we conduct). We did not hold it directly.

"The engagement process with each fund house was slow moving due to the ongoing enquiry, so a quick resolution was not possible. Each fund house was actively engaging with Kingspan on the matter, something we would expect. WHEB's dialogue and response was highly commendable."

He added the house no longer has any exposure to the firm, which he described as having "structural cultural issues" and "prioritised profits over safety".

ASI Europe ex UK Ethical Equity remains invested in Kingspan, with abrdn highlighting that its insulation was "used for less than 5% of the Grenfell building".

"The cladding system which K15 was used in combination with, was not one approved for the situation," it added. "Kingspan has subsequently cooperated fully with the Grenfell Inquiry."

Kingspan has apologised for "the unacceptable actions of a small group of former employees which emerged through the Inquiry", adding that they do not reflect its cultures or values and that evidence has shown these "shortcomings" were not "causative of the failures that led to the Grenfell Tower fire".

Founding director of SRI Services Julia Dreblow explained that active ethical investors had only two options as a result of the "predictable and avoidable" tragedy: fight or flight.

"My understanding is that some fund managers chose to retain holdings, with the aim of trying to force improvements so that residents elsewhere would benefit - whereas others will have very understandably decided to have no more to do with companies, particular given how some have behaved," she said.

"In terms of ‘right or wrong' - it is difficult to say without seeing the whites of senior company management's eyes - but one of the key messages here is that this is exactly what active managers can, and must do, if they chose not to exit when things go badly wrong.

"There must be no sitting on the fence."