Despite global stock and bond markets suffering one of the most difficult drawdowns in living memory, the case for low-cost index investing has never been more compelling.

In times of market turmoil, it's natural for investors to want to take action and try to protect their portfolios. As the uncertainties persist, the narrative that actively-managed strategies may be better equipped to navigate these choppy markets than their lower-cost indexing peers tends to arise.

However, the data tell a different story. Less than a third (30.5%) of active equity funds outperformed their market benchmarks in the difficult conditions of 2022, according to research by Morningstar1. In fixed income markets—where many investors assumed that the rising rate environment would give active fixed income managers an advantage—less than half of active bond funds (46%) beat their benchmarks2.

Vanguard's own analysis—outlined in our 2023 update of The case for low-cost index-fund investing—confirms these findings. In our latest study, our researchers analysed the performance of domestic equity and bond funds in a variety of circumstances, including diverse time periods and market cycles, and found that, on average, active strategies struggled to deliver excess returns above their market benchmarks. And the longer the time period, the more difficult the challenge - as the higher costs and persistent need to outperform dragged down the returns of active managers relative to their low-cost, market-tracking index peers.

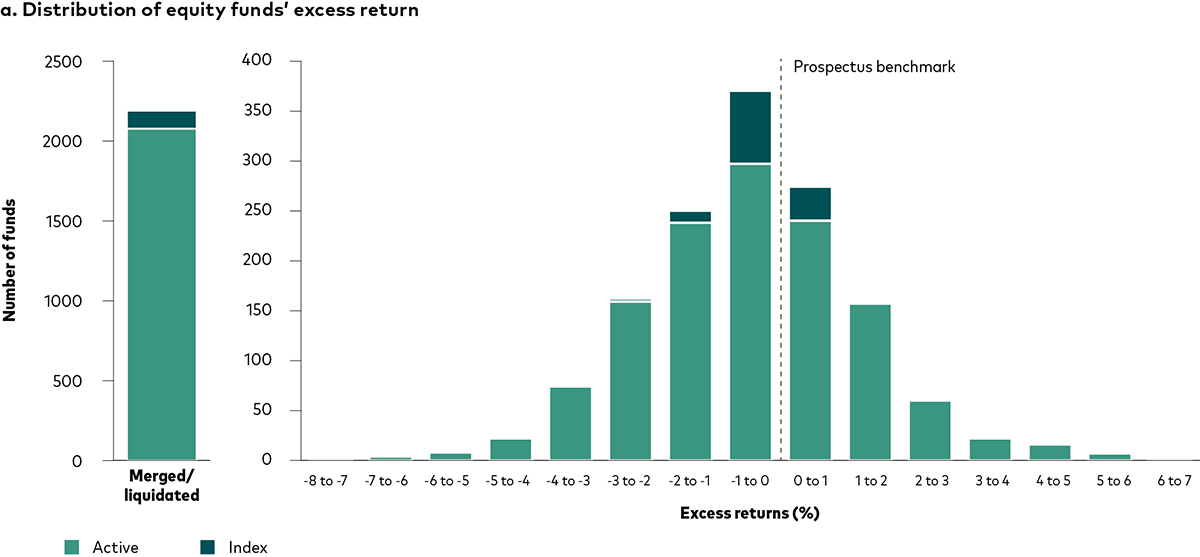

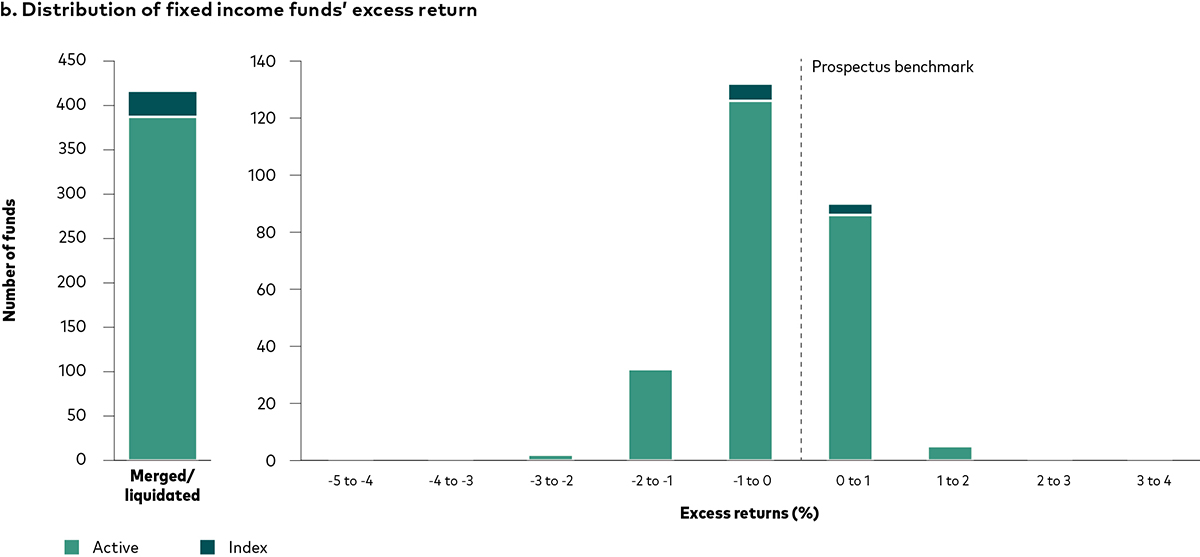

The figures below show the distribution of excess returns for domestic equity and bond funds over the last 15 years, net of fees. In both asset classes, a significant majority of actively managed funds' returns lie to the left of their benchmarks—meaning that the higher costs of active funds made them much more likely to underperform than outperform their market benchmarks over the same time period.

Distribution of UK equity and fixed income funds' excess returns over the last 15 years

Past performance is no guarantee of future results.

Notes: Charts a. and b. display distribution of equity and bond mutual funds' and ETFs' excess returns relative to their prospectus benchmarks for the 15 years to 31 December 2022. NAV-based performance; returns calculated in GBP, net of fees with income reinvested. Only funds available for sale in the UK are included.

Sources: Vanguard calculations, based on data from Morningstar, Inc.

You get what you don't pay for

No one can predict future market movements, but there are ways for investors to protect their portfolios from funds that are likely to underperform.

Research consistently shows that a fund's costs are the most reliable indicator of its ability to outperform over the long term3. In our latest study, we explore how the impact of higher costs compounds over time, such that the likelihood that an active manager will be able to overcome the drag of higher costs diminishes as time goes on. As a result, for most long-term investors, their best chance of maximising long-term returns lies not in seeking active strategies that can outperform, but in minimising their costs.

Still, it can be challenging for investors to appreciate the impact of higher costs on long-term returns. For example, the difference between a low-cost index fund charging 0.20% and a higher-cost strategy charging 0.80% may not be apparent over the course of a single year; however, when compounded over several decades, this 60-basis point fee differential can make a significant difference in the long-term performance of the two funds.

Simple, low-cost investing

Low-cost index funds and ETFs are one of the simplest ways for investors to gain broad market exposure at a minimal cost. By their very nature, index strategies track their target markets as closely as possible and, by extension, provide near-market returns to investors. And because they do not seek to outperform their target markets, they do not face the challenges and extra costs of persistent outperformance that confront active managers.

That's not to say there's no place for active strategies. Indeed, for investors who desire active management, the challenge is finding the active funds whose approach increases the likelihood of outperformance. As we outline in our Active Edge approach to active investing, there are hallmark characteristics of active managers that can give investors an edge over other active peers in the long run.

Remember to stay focused

When markets are volatile, it can be helpful to remind investors that it takes decades to achieve long-term investing outcomes; during which their portfolios will endure the ups and downs of multiple market cycles, economic regimes and major global events. Finding active managers that can consistently outperform, year after year, through all market environments is extremely challenging, and can introduce higher costs and uncertainties into portfolios. Given these challenges, for most investors, we continue to believe their best chance of successfully investing over the long term lies in low-cost, broadly diversified index funds.

This post is funded by Vanguard

1 Source: Morningstar. Includes all funds listed in Morningstar's EAA open-end and exchange-traded funds database, for the 12-month period ending 31 December 2022. For more information, see Morningstar's 2023 Active Passive Barometer report.

2 Source: ibid.

3 Source: Morningstar and Vanguard. In a 2010 analysis across universe of funds, researchers found that, regardless of fund type, low expense ratios were the best predictors of future relative outperformance (Kinnel, 2010).

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

This document is directed at professional investors and should not be distributed to, or relied upon by retail investors. This document is designed for use by, and is directed only at persons resident in the UK.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so.

The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Asset Management Limited. All rights reserved.