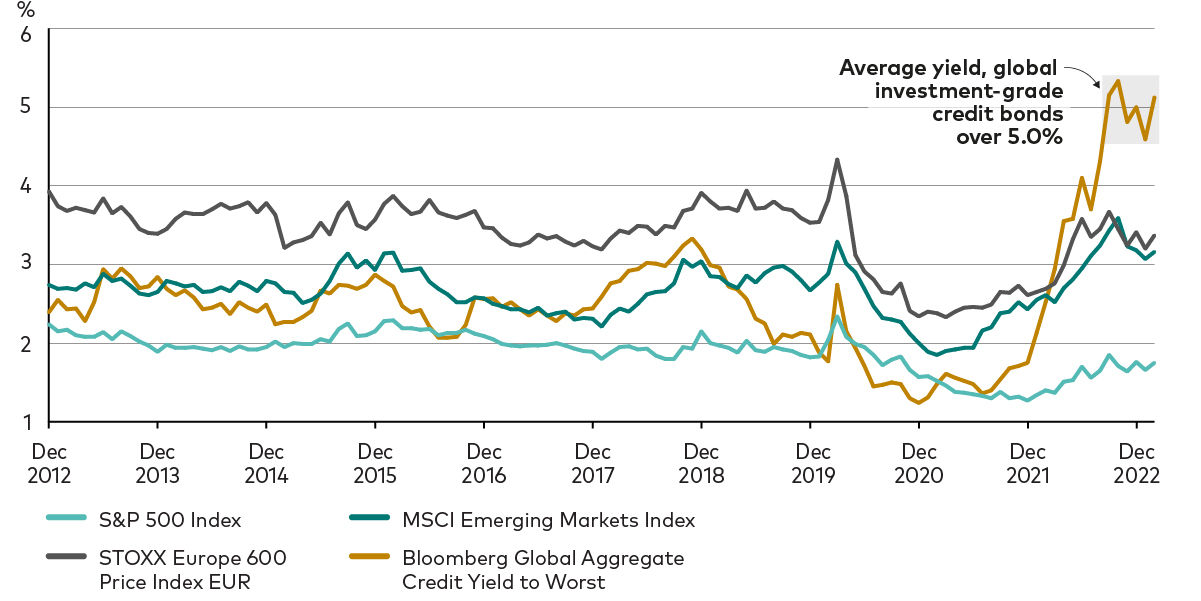

Income is one driver of this resurgence in interest - the average yield on global investment-grade credit bonds, at over 5.0%, has far surpassed the dividend yields available on most equity markets1, as the chart below shows. For example, dividends on European and emerging market equities are both currently below 3.5%, while those paid by US S&P 500 companies average less than 1.8%2.

Global credit yields surpass equity dividend yields

Source: Bloomberg, data from 31 December 2012 to 28 February 2023. Indices used for equity dividend yields: S&P 500 Index; STOXX Europe 600 Price Index EUR; MSCI Emerging Markets Index. Index used for global credit yield-to-worst: Bloomberg Global Aggregate Credit Index.

However, despite the rosier outlook for the asset class, it's important to be mindful of the threats facing investors in active credit funds that could threaten returns if not navigated correctly.

A fast-changing narrative

So far in 2023, the narrative driving credit markets has been fast-changing. At the beginning of the year, the big themes of 2022—namely high inflation and rising interest rates—morphed into concerns around slowing growth and rising credit risk. More recently, speculation around higher-than-expected growth (and the resulting prospect of further monetary tightening) has come back to the fore.

Although growth expectations have continued to pick up, we believe that the risks are tilted towards slowing growth - and moreover that current valuations in credit markets broadly underestimate this risk. As it stands, we don't believe that credit spreads have fully priced in the risk of recession yet. Within investment-grade corporates, we believe that spreads are not currently pricing in sufficient risk premium despite the recent rally for cyclical sectors. And high-yield credit valuations in particular are stretched relative to those of higher-quality credit bonds, with current spreads below historical averages and offering little room to absorb too many more negative economic surprises, in our view.

An impending credit market shakeup

When recession strikes—which we expect to occur in the US late this year—as profit margins erode and increasing numbers of corporate issuers refinance at higher rates than they have been accustomed to paying on debt in recent years, credit risk will likely increase. This would cause a shakeup in credit markets, prompting a boost in demand for bonds at the upper end of the credit quality spectrum at the expense of lower-credit-quality instruments.

The big implication for investors in active credit bond funds is that in this scenario, we would expect to see greater price dislocation in the credit market. In other words, more credit bonds will diverge from their fair value, some offering attractive value opportunities to take overweight positions relative to the benchmark, others representing ones to avoid (or underweight).

We are already observing these dislocations opening up in a number of sectors across the global credit universe. For example, in terms of underweights, real estate investment trusts (REITs) specialising in retail and office properties stand to lose out disproportionately as a result of the higher interest rate environment. Furthermore, the supply-demand dynamics of this part of the industry could be hard-hit during a recession. Similarly, we see the automotive sector as one of the potential losers in a downturn scenario, and carmakers face the added pressure of ongoing supply-chain disruption which began in the aftermath of the Covid-19 pandemic and are yet to fully resolve3.

Among overweights, banking is a sector which typically benefits from higher prevailing interest rates, and we see particular value in European banks, though—as highlighted by the US Federal Reserve's recent emergency intervention to shore up the US banking sector—we are wary of asset-quality risk. We also see interesting opportunities in the food and beverage sector, although here persistent inflation pressures could eat away at issuers' margins. Overall, given the potential risks ahead, we are conservative in our active positioning based on these views, with a bias towards higher-quality, defensive sectors.

Picking out opportunities in a dislocated market

Attempting to time macroeconomic shifts is notoriously challenging—even for professional active bond fund managers—and in the current environment, getting broad directional calls correct arguably has an even lower probability of success than usual.

Amid the burgeoning dislocation we are observing in credit markets, taking a bottom-up approach to security selection in managing active credit has a distinct advantage, not least in that it typically exposes investors to a much lower risk of large drawdowns4. And as central banks unwind years of quantitative easing, taking into account the shifting technical backdrop that this creates—which is a core part of our approach to managing active bond funds—is also becoming increasingly important in generating alpha in fixed income.

This post is funded by Vanguard

1 Source: The average yield-to-worst of the Bloomberg Global Aggregate Credit Index was 5.12% as at 28 February 2023.

2 Source: Bloomberg as at 28 February 2023. The average dividend yields of the STOXX Europe 600 Price Index EUR, the MSCI Emerging Markets Index and the S&P 500 Index were 3.37%, 3.16% and 1.75% respectively as at 28 February 2023.

3 Source: Vanguard.

4 Source: Vanguard.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Vanguard Emerging Markets Bond Fund may use derivatives, including for investment purposes, in order to reduce risk or cost and/or generate extra income or growth. For all other funds they will be used to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Funds net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

The Vanguard Global Credit Bond Fund may use derivatives, including for investment purposes, in order to reduce risk or cost and/or generate extra income or growth. For allother funds they will be used to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Funds net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the "Risk Factors" section of the prospectus on our website at https://global.vanguard.com.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

For Swiss professional investors: Potential investors will not benefit from the protection of the FinSA on assessing appropriateness and suitability.

Vanguard Investment Series plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Investment Series plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor of Vanguard Investment Series plc.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

For investors in Ireland domiciled funds, a summary of investor rights can be obtained via https://www.ie.vanguard/content/dam/intl/europe/documents/en/vanguard-investors-rights-summary-irish-funds-jan22.pdf and is available in English, German, French, Spanish, Dutch and Italian.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited ("BISL") (collectively, "Bloomberg"), or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices.

The products are not sponsored, endorsed, issued, sold or promoted by "Bloomberg." Bloomberg makes no representation or warranty, express or implied, to the owners or purchasers of the products or any member of the public regarding the advisability of investing in securities generally or in the products particularly or the ability of the Bloomberg Indices to track general bond market performance. Bloomberg shall not pass on the legality or suitability of the products with respect to any person or entity. Bloomberg's only relationship to Vanguard and the products are the licensing of the Bloomberg Indices which are determined, composed and calculated by BISL without regard to Vanguard or the products or any owners or purchasers of the products. Bloomberg has no obligation to take the needs of the products or the owners of the products into consideration in determining, composing or calculating the Bloomberg Indices. Bloomberg shall not be responsible for and has not participated in the determination of the timing of, prices at, or quantities of the products to be issued. Bloomberg shall not have any obligation or liability in connection with the administration, marketing or trading of the products.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index referenced herein is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2016, J.P. Morgan Chase & Co. All rights reserved.

For Dutch investors only: The fund(s) referred to in this document are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht).For details of the Risk indicator for each fund listed in this document, please see the fact sheet(s) which are available from Vanguard via our website https://www.nl.vanguard/professional/product.

For Swiss professional investors: The Manager of Vanguard Investment Series plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA. Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice.

Vanguard Investment Series plc has been authorised by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation. Vanguard Investment Series plc has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). The information provided herein does not constitute an offer of Vanguard Investment Series plc in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for Vanguard Investment Series plc. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KIID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH via our website https://global.vanguard.com/.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.