Volatility goes hand in hand with China’s higher long-term return potential. Understanding the dynamics at play can help make these changes easier to take in stride.

1. China equities have always exhibited higher volatility - and attractive returns

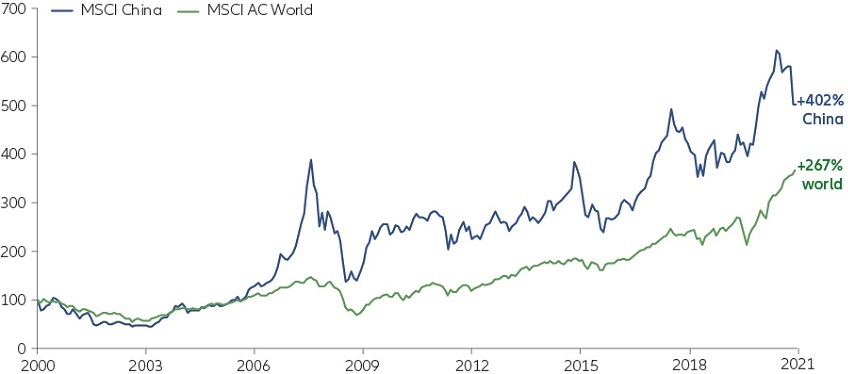

Investing in China brings different risks and greater unpredictability compared with Western markets. The Chinese government's recent clampdown on tech firms and education companies illustrates this point. But investors have historically been rewarded with long-term outperformance. Indeed, as Exhibit 1 shows, an investment in the MSCI China Index from January 2000 to the end of August 2021 would have generated a 402% return. In the past, moments of volatility like this have proved to be buying opportunities for many long-term investors.

Exhibit 1: MSCI China and MSCI ACWI performance since 2000 (in USD, indexed to 100)

Source: Bloomberg, Allianz Global Investors. Data as at 31 August 2021. Based on total return performance in gross, in USD. Past performance is not indicative of future results.

2. The US and EU were already focused on regulating big tech

There are many ways for investors to buy shares of Chinese companies. This has become even more important during China's recent regulatory clampdown, which affected some listings - particularly US-listed American depositary receipts (ADRs) and select Hong Kong-listed companies - more than others. With China A-shares constituting almost 70% of China's total market capitalisation size, China's capital markets are much broader and deeper than many investors realise (see Exhibit 2).

Exhibit 2: Major stock exchanges for China equities vs euro area

Source: Shenzhen Stock Exchange, Shanghai Stock Exchange, Hong Kong Stock Exchange, Bloomberg, Allianz Global Investors. Data as at 30 June 2021. The total figures are for comparison only. The stocks included may be listed in more than one exchange. Offshore China stocks are defined based on companies with ultimate parent domiciled in China. Suspended stocks, investment funds and unit trusts are excluded.

3. China's A-shares were less affected by recent volatility

The regulatory clampdown on tech giants and education firms didn't affect China A-shares as much as other listings (see Exhibit 3). It's another reasons for investors to explore the broad universe of Chinese equities - regardless of where the stocks are listed.

- Internet, education and ecommerce stocks tend to be better represented in Hong Kong-listed stocks and US-listed ADRs (American depositary receipts).

- A-shares (stocks of Chinese companies listed on exchanges in Shanghai or Shenzhen) tend to feature more companies in sectors such as industrials, healthcare and consumer goods.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Past performance is not a reliable indicator of future results. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Further information on Investor Rights are available here (www.regulatory.allianzgi.com), Allianz Global Investors GmbH has established a branch in the United Kingdom, Allianz Global Investors GmbH, UK branch, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk, deemed authorised and regulated by the Financial Conduct Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority's website (www.fca.org.uk). Details about the extent of our regulation by the Financial Conduct Authority are available from us on request.