In the latest instalment of the ‘Four graphs explaining' series, experts consider sterling.

Orla Garvey, senior portfolio manager for fixed income at Federated Hermes

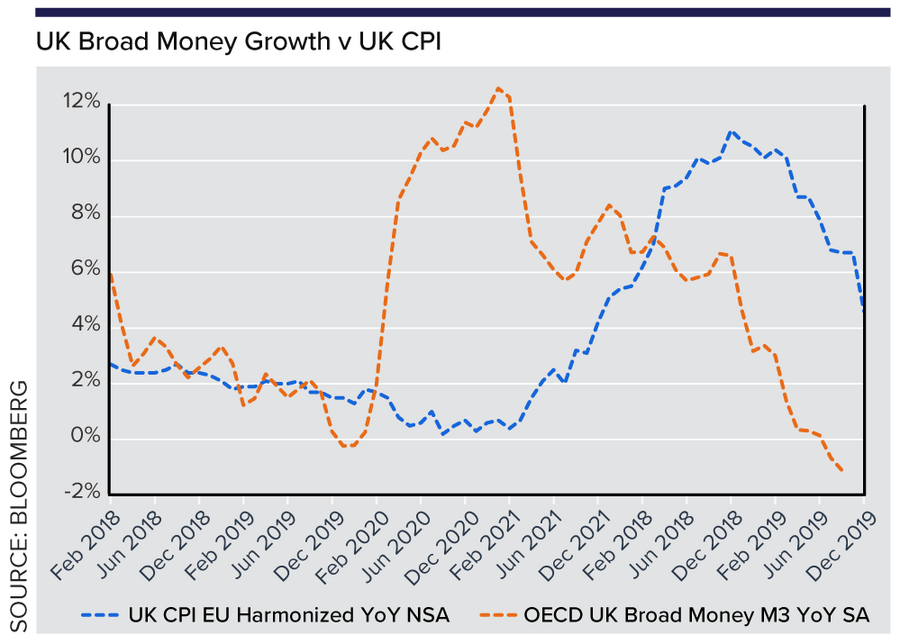

Broad money growth in the UK has declined meaningfully in 2023, which supports our 2024 expectations that focus will continue to shift from concerns around inflation to concerns around growth.

We believe that this downside growth concern is not fully reflected in the Bank of England's rate expectations into next year.

We see front end gilts outperforming, with the curve steepening.

This was supported by the Autumn Statement, with the chancellor loosening fiscal policy, showing the Tories are not afraid to spend money and do it upfront.

This will of course have implications for what is to come as we get closer to the general election.